Michael Halkitis, the Minister of Economic Affairs, recently addressed concerns about the Department of Inland Revenue (DIR)’s focus on average Bahamians who owe real property tax payments. He explained that the main targets are foreign and commercial property owners responsible for most of the $822,167,685 in unpaid real property tax.

Earlier this month, the DIR issued a warning in a newspaper ad that properties classified as commercial, residential, foreign-owned vacant land, or foreign-owned and overdue on tax payments for more than seven months could potentially be sold off.

FNM Chairman Dr. Duane Sands

This announcement triggered widespread concern, with Free National Movement (FNM) Chairman Dr. Duane Sands suggesting that the government intended to extract money through tax collection from Bahamian property owners.

During a press conference at the Prime Minister’s Office, Halkitis revealed that foreign property owners owe $226 million, while commercial properties account for another $235 million. “These properties generate income either as businesses or rentals,” said Halkitis.

He continued, “Imagine if we could recover the entire $822 million. It may not be possible, but we could retrieve a significant portion. We are particularly stepping up efforts to collect from foreign property owners. The aim is mainly at persistent defaulters who have been overdue for years. There seems to be a misconception that the government is targeting Bahamian homeowners.”

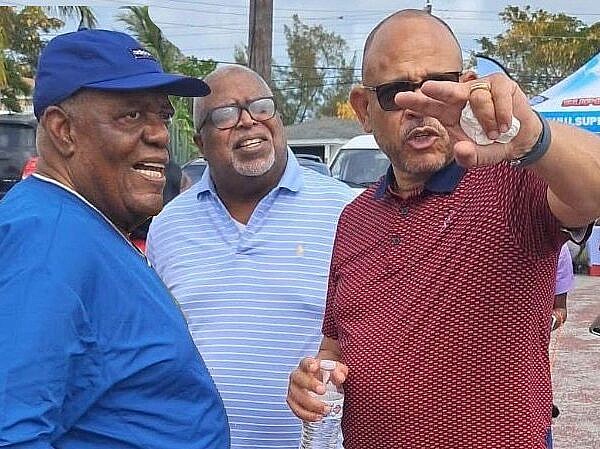

Minister of Economic Affairs Sen. Hon. Michael Halkitis

Halkitis pointed out that of the $822 million overdue, only $155 million is owed by owner-occupied properties, where most Bahamians fit.

While the DIR has shown patience with property owners disputing their tax debts, Halkitis stressed the urgency of addressing delinquency, especially concerning foreign-owned properties.

“We’re dealing with a serious issue here. A large percentage is due from foreigners. We’re implementing measures to pursue them, and that will be our primary emphasis,” he elaborated.

“The department has been understanding towards individuals who have queries or objections about their taxes. We’re faced with a significant problem that we need to tackle. Particularly with foreign-owned properties where the decrease has been slow, we need to transition from asking to exercising our powers. This wasn’t meant to target Bahamian homeowners, despite the fear spread that the government was after their homes.”

Recently, the DIR has taken a stronger approach, warning those in tax arrears of potential actions. Earlier this month, the DIR announced that it has begun to seize the bank accounts of businesses that are significantly overdue and have not made arrangements to clear their debt with the government. However, this is only being implemented in extreme cases.

More from LOCAL

Sands cannot live without washed-up Ingraham. It’s so sad.

The Bahamas is once again being asked to suspend disbelief. We are being told that Duane Sands stands as an …

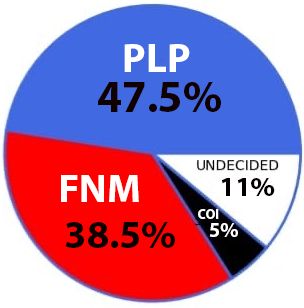

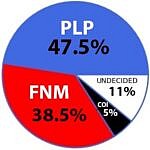

Recent Poll Shows Strong Confidence in PLP Leadership and Doubts About FNM Stability

A recent unscientific poll, conducted among Bahamians ages 18 to 60 in the "over the hill" area, shows the Progressive …

ZANE LIGHTBOURNE, MORE ACTION, LESS TALK.

In politics today, noise often masquerades as leadership. Grand speeches trend online. Manufactured outrage fills timelines. But in Yamacraw, residents …