Grand Bahama Port Authority: A Story of Vision, Controversy, and Divestment

The Grand Bahama Port Authority (GBPA) has been a central figure in the economic development of Grand Bahama Island since its establishment in 1955. Founded by American financier Wallace Groves, the GBPA was granted extraordinary control and concessions by the Bahamian government through the Hawksbill Creek Agreement. This arrangement was pivotal in transforming an underdeveloped island into a hub of industrial, commercial, and tourist activity. However, the GBPA’s journey has been fraught with challenges, controversies, and a strategic shift that saw it divesting key assets. This article explores the complex legacy of the GBPA, shedding light on its pivotal role in shaping Grand Bahama Island.

Early Ambitions and Rapid Growth

The GBPA’s early years were marked by ambitious projects aimed at exploiting the island’s strategic location near the United States. The vision was to create an industrial free port complemented by a thriving tourist destination. Investments flowed in, infrastructure expanded, and Freeport quickly grew into a vibrant community. However, this rapid expansion was not without its challenges.

Controversies and Governance Issues

As the GBPA expanded, it attracted scrutiny and criticism. Allegations of ties to organized crime, particularly concerning the operation of casinos, raised questions about governance and the influence of external actors. The involvement of notable figures like Louis Chesler and connections to Meyer Lansky’s casino operations brought the GBPA under intense media and regulatory scrutiny.

Navigating Political Waters

The unique status of the GBPA often placed it at odds with the Bahamian government, especially as the nation sought greater economic independence. Disputes over land, taxes, and the extent of the GBPA’s autonomy underscored the complex relationship between the authority and the state. These tensions were exacerbated by the GBPA’s significant control over the island’s economy and resources.

Governance and Transparency Issues

Over the years, governance and transparency issues have plagued the GBPA. The structure of the GBPA, which endowed it with quasi-governmental powers without the corresponding oversight, led to conflicts of interest and opaque decision-making processes. Critics argue that the GBPA operated more as a private entity focused on profit rather than as a steward of sustainable development for Grand Bahama.

Economic Stagnation and Missed Opportunities

Despite the initial rapid growth, Freeport and the broader Grand Bahama region have faced economic stagnation. The GBPA has been criticized for failing to diversify the economy, over-reliance on a few key industries, and inability to attract new and sustainable investments. The failure to adapt to changing global economic conditions and to adequately support and nurture small and medium-sized enterprises contributed to this stagnation.

Infrastructure and Social Commitments

The GBPA has also been accused of neglecting its infrastructure and social commitments under the Hawksbill Creek Agreement. There have been reports of inadequate maintenance of public facilities and utilities, leading to quality-of-life issues for residents. Moreover, commitments to environmental sustainability and community development have been perceived as insufficient.

Recent Government Actions

The most recent development involves the government’s official response to the GBPA’s unmet obligations under the Hawksbill Creek Agreement. The Office of the Prime Minister has highlighted that the GBPA has failed to fulfill its responsibilities, leading to widespread suffering in Freeport. The government, acting on behalf of the Bahamian people, is now seeking reimbursement of $357 million for services that were the GBPA’s legal responsibility from 2018 to 2022. This move underscores the government’s stance on holding the GBPA accountable and reflects the escalating tensions between the two entities.

The relationship between the Grand Bahama Port Authority (GBPA) and the Bahamian Government has reached a critical juncture, marked by disputes and financial contention that threaten the economic vitality of Grand Bahama Island (GBI). This deterioration stems from a complex interplay of economic stagnation, governance issues, and a stark divestiture of assets by the GBPA, which has significantly undermined its operational and developmental capacities.

Historical Ambitions Meet Economic Realities

The GBPA, established under the visionary Hawksbill Creek Agreement (HCA) in 1955, was tasked with transforming Grand Bahama into an industrial and commercial powerhouse. Initially, the partnership flourished, with Freeport evolving into a bustling economic zone. However, the economic landscape began to shift, with the GBPA’s ambitious development plans stalling amidst global economic changes and internal governance challenges.

Strategic Missteps and Asset Divestiture

In a pivotal move, the GBPA divested its key money-making assets, including utility companies and essential infrastructure services, to focus on regulatory and administrative functions. This decision stripped the authority of significant revenue streams and the financial leverage needed to drive Freeport’s and GBI’s development, as initially envisioned in the HCA.

Fiscal Strains and Government Reckoning

The divestiture and subsequent operational limitations of the GBPA have had profound fiscal implications for the Bahamian Government. With the GBPA unable to fulfill its infrastructural and developmental commitments, the government has found itself shouldering a growing financial burden, especially in providing services and infrastructure for which the GBPA was originally responsible. Estimates suggest that the government incurs a larger deficit on GBI compared to the national average, exacerbating tensions between the two entities.

The Crux of the Contention

A significant point of contention arose from the GBPA’s obligations under the HCA, specifically its responsibility to reimburse the government for certain provided services, juxtaposed against the backdrop of Freeport’s granted tax concessions. The government’s recent demands for reimbursement, citing unmet obligations by the GBPA, have ignited a fierce legal and public debate about the authority’s role and its commitments to GBI’s development.

The complexities surrounding the GBPA’s divestiture of assets, its operational and financial challenges, and the fiscal impact on the Government underscore the need for a comprehensive review and renegotiation of the HCA. There is a clear necessity for reforms that would ensure the GBPA’s alignment with its foundational goals, including sustainable economic development for GBI and improved governance structures to ensure transparency, accountability, and effective fulfillment of its obligations.

More from LOCAL

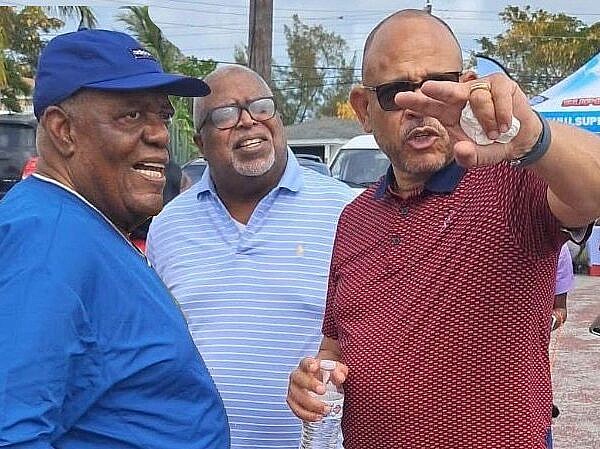

Sands cannot live without washed-up Ingraham. It’s so sad.

The Bahamas is once again being asked to suspend disbelief. We are being told that Duane Sands stands as an …

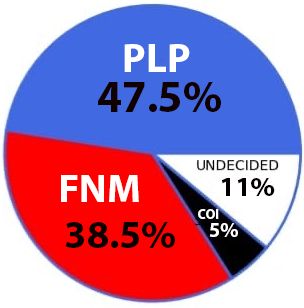

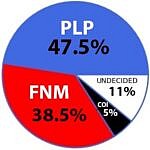

Recent Poll Shows Strong Confidence in PLP Leadership and Doubts About FNM Stability

A recent unscientific poll, conducted among Bahamians ages 18 to 60 in the "over the hill" area, shows the Progressive …

ZANE LIGHTBOURNE, MORE ACTION, LESS TALK.

In politics today, noise often masquerades as leadership. Grand speeches trend online. Manufactured outrage fills timelines. But in Yamacraw, residents …